Calculating taxes can be a big part of budgeting, especially if you’re moving to a foreign country for the first time. Check out this easy-to-use tax chart and tax calculator!

The People’s Republic of China uses a progressive tax system, with tax rates ranging from three to 45 percent. A progressive system means that tax brackets increase with respect to your taxable income.

The tax year ends on December 31st each year.

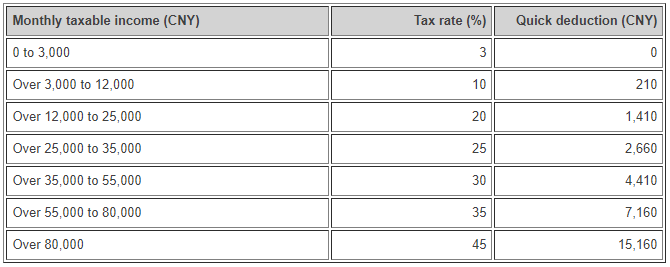

Tax brackets as of 2024:

Calculating your tax:

Download our easy-to-use tax calculator if you have Microsoft Excel, and figure out approximately what you’ll be paying in income taxes!

Download and use the tax calculator

Understanding income taxes:

Foreigners who legally work in China enjoy an initial tax deduction of 5,000 RMB per month. Only income over this amount is taxed. Furthermore, you should note that not all of your salary is within the same tax bracket.

For example, as of 2020, the first 1,500 RMB over your initial deduction of 5,000 RMB is taxed at 3% and then your next 3,000 RMB is taxed at the 10% bracket, and so on.

To make this calculation easier, use the quick deduction when finding out how much tax you owe each month. To calculate how much you owe in tax each month, use the following formulas:

Taxable Income = Gross Salary – 5,000 RMB

IIT = Taxable Income * Tax Rate – Quick Deduction

Net Salary = Gross Salary – IIT

Example:

If you earn 10,000 RMB a month:

10,000 RMB – 5,000 RMB = 5,000 RMB of taxable income (TI)

5,000 RMB TI * 0.1 tax rate – 210 RMB quick deduction = 290 RMB IIT

10,000 RMB gross salary – 290 IIT = 9,710 RMB net salary

This results in an effective tax rate of 2.90%.

Remember, some employers give additional tax benefits such as a housing allowance, which is a tax-free portion of your salary if spent on rent. This lowers your effective tax rate even more.